Past

Private high-level meeting on climate liability and litigation at Paris COP21

Paris , FranceThe Bank of England's Prudential Regulation Authority recently pointed out that fiduciaries, including company directors and pension fund trustees, could be held liable for i) contributing to anthropogenic climate change and ii) not reasonably managing the risks associated with climate change. The Bank, and others, have said that this could potentially have significant implications for…

Oxford Sustainable Finance Summit 2022 – Biodiversity and nature session

University of OxfordHalting and reversing the ongoing loss and degradation of nature and its biodiversity are amongst the greatest challenges of our time. The current state of play is deeply worrying. The drivers of habitat destruction and biodiversity loss continue and we are not yet able to deploy capital into nature recovery at the scale or pace…

Oxford Sustainable Finance Summit 2022 – Climate litigation and liability session

University of OxfordLitigation has the potential to help drive the transition to a net zero economy by holding corporations and financial entities to their net zero transition plans, and to re-allocate capital where liability risks are priced into financial decision-making. Yet the risks, opportunities and impacts of climate litigation are not widely understood by financial market participants,…

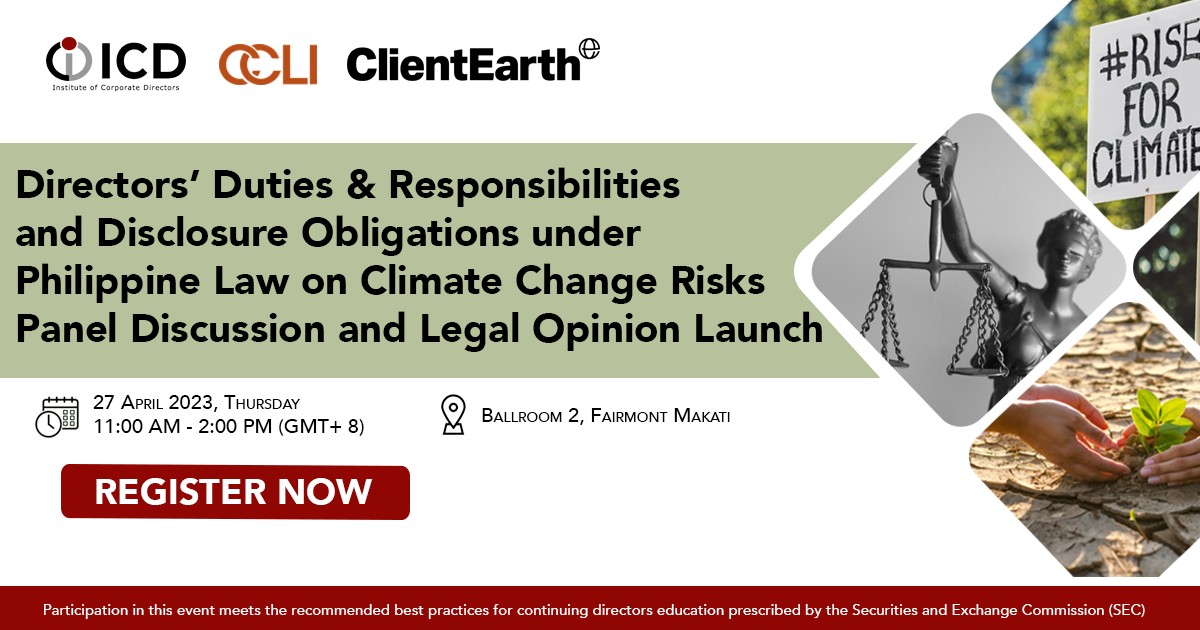

In-person launch of the legal opinion, ‘Directors’ Duties & Responsibilities and Disclosure Obligations Under Philippine Law On Climate Change Risks’

The Fairmont Makati, Makati, The Philippines The Fairmont Makati, 1, Raffles Drive, Makati Ave, Makati, Metro Manila, PhilippinesAfter a successful soft launch at an online roundtable in November 2022, the Commonwealth Climate and Law Initiative (CCLI), together with ClientEarth and the Institute of Corporate Directors (ICD) launched the legal opinion at an in-person event, 'Directors’ Duties & Responsibilities and Disclosure Obligations Under Philippine Law On Climate Change Risks'. The launch event was…

Oxford Sustainable Finance Summit 2023 – Achieving the aims of the biodiversity framework: What role for finance?

After two years of delays, COP15 was finally held in December, bringing together nearly 200 governments to negotiate a global agreement on biodiversity and conservation. The resulting Kunming-Montreal Global Biodiversity Framework is being hailed by some as a ‘Paris Agreement for Nature’. It commits signatories to act to conserve 30% of land, sea and freshwater…

Oxford Sustainable Finance Summit 2023 – Legal innovations: what key legal strategies are being deployed to further sustainable finance?

Sustainable finance is a rapidly developing area of legal innovation. Courts are being asked by shareholders to ensure that corporations are sufficiently ambitious in their climate targets and to rule on class actions alleging that companies’ ESG-related disclosures are inaccurate. Outside the courtroom, corporate and finance lawyers have an important role to play in ensuring…

Launch of New Legal Opinion – UK Company Directors and Nature-related Risk

The Law Society 113 Chancery Lane, London, United KingdomThe Commonwealth Climate and Law Initiative (CCLI), together with Pollination, launched the legal opinion at an in-person event, ‘Legal Opinion: Directors' Duties & Nature Risk’. The launch event was held on 13 March 2024, from 08:00 AM to 11:00 PM at The Law Society, London. The legal opinion, authored by a team of corporate and…

Climate and ESG Legal Risk Management Summit 2024 – A practical guide for companies and their investors

Cavendish Conference Centre.In the context of a rise in climate change-related litigation and activism, City & Financial Global hosted an event titled, 'Climate and ESG Legal Risk Management Summit' in London, on the 25th March 2024. The event provided an analysis of key issues and practical guidance on how to mitigate such risks effectively. Our Biodiversity Risk…