Author: Alex Cooper

Date: 31 October 2022

The International Energy Agency (IEA) advises fossil fuel producing nations on energy policy and produces annual analysis and predictions on energy consumption, production and policy which are regarded as influential by governments and companies. On 27 October, the IEA published its World Energy Outlook 2022 (WEO 2022), its most authoritative source of analysis and projections.

The IEA made headlines in May 2021 with the publication of its Net Zero Emissions scenario (NZE) setting out “the most technically feasible, cost‐effective and socially acceptable” pathway to reach the net zero greenhouse gas emissions by 2050. This pathway sets out a number of milestones, including no new oil fields, natural gas fields or coal mines being required, due to a substantial reduction in the demand for oil, gas and coal, no new internal combustion car sales after 2035, falls in fossil fuel prices, and a rapid switch to renewable-generated electricity between 2020-2030. The NZE has been cited in climate litigation as a benchmark which companies should meet in order to meet their net zero targets, or to avoid causing harm to third parties.

The WEO 2022 sets out three scenarios: a revised NZE, the Announced Pledges Scenario (APS), which assumes that governments will meet, in full and on time, all of the climate‐related commitments that they have announced, and the Stated Policies Scenario (STEPS), which analyses actual policies and measures in place.

The IEA states that the pathway detailed in the NZE remains narrow but still achievable. The NZE has been revised following the ongoing carbon-intensive recovery to the Covid-19 pandemic and the effect of geopolitical events on the global energy market. It includes lower production and consumption of Russian gas and oil, as well as factoring in a further year of delay in achieving the milestones of the 2021 NZE.

In the APS and STEPS, emissions do not reach net zero by 2050; as a result the IEA predicts a global average temperature rise of 1.7°C under APS, and 2.5°C under STEPS, by 2100. The Intergovernmental Panel on Climate Change (IPCC) has analysed the likely impacts of missing the 1.5°C target compared to a 2°C temperature rise, including increased temperature extremes and weather events, increased sea level rise and increased species extinction.

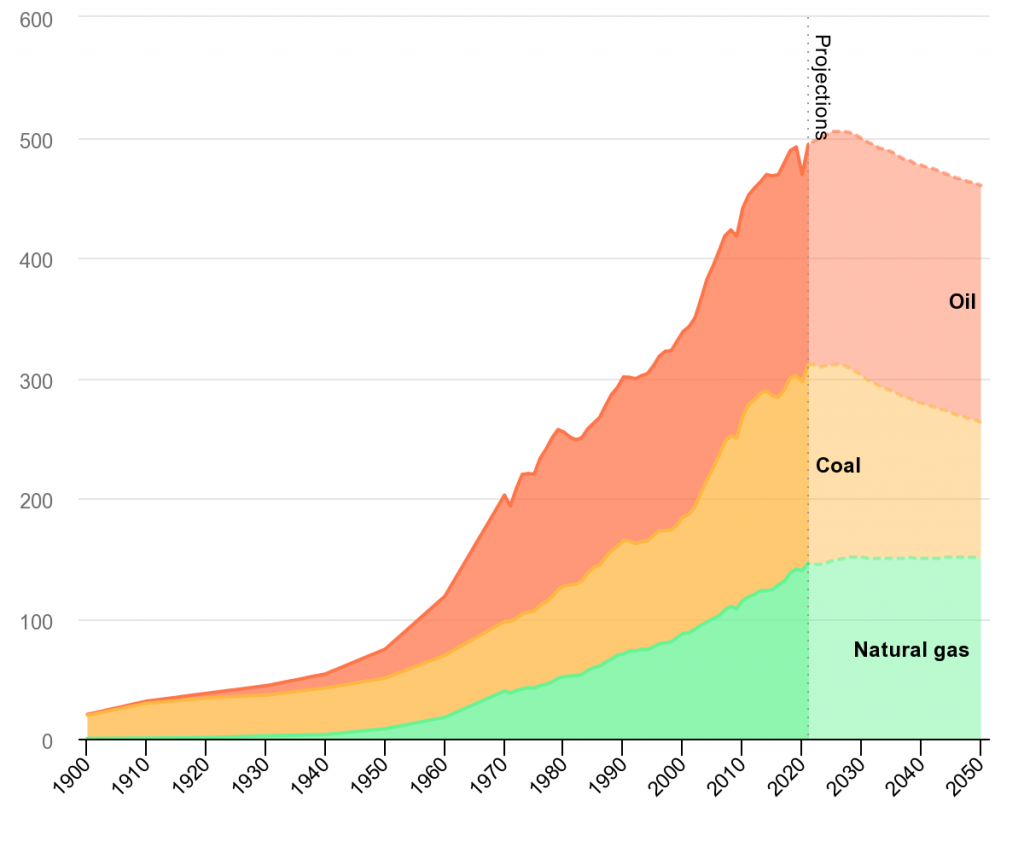

However, both the APS and STEPS forecast a fossil fuel peak before 2030, with the share of fossil fuels in average global supply decreasing from 80% to 75% by 2030. Indeed, the IEA finds that at the current rate, renewable energy growth would outpace its forecast in STEPS. While these scenarios both see some continued fossil fuel investment in the coming years, they see much greater investment in renewables. Notably, the current uptick in coal consumption is seen as being temporary only.

What does this mean for corporate and financial decision-makers? While the IEA scenarios are only projections of how the energy sector might evolve, they are influential. Directors and investment managers of entities which are involved in or exposed to the energy sector should consider how their own forecasts align with those projected by the IEA, and whether they are managing the relevant risks and opportunities in an appropriate manner.

In particular, directors and investment managers should consider whether significant differences could expose them to litigation risk. We have already seen claims brought against companies who have made net zero commitments but failed to match these with actions (e.g. against Australian energy company Santos alleging that its statements in its 2020 annual report regarding the use of natural gas in its transition plan were misleading).

The WEO 2022 maps a complex and risky world, and projects significant changes as part of the energy transition; many of which are a case of ‘when’ not ‘if’. Decision-makers should consider carefully how to manage their assets through these challenges.