The Commonwealth Climate and Law Initiative (CCLI) has partnered with the Climate Governance Initiative (CGI) to prepare this Quarterly Update for the CGI network.

This is the third update of a series of quarterly learning materials on climate change as it relates to boards’ duties and governance.

KEY POINTS ON VALUE CHAIN DUE DILIGENCE

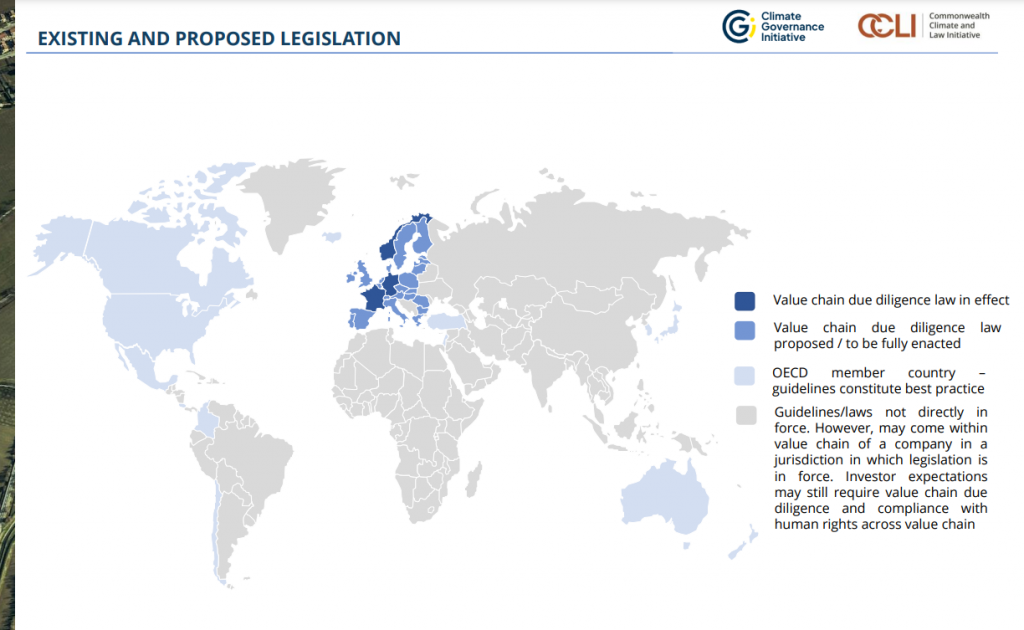

• New legislation and existing guidance require and encourage companies to carry out due diligence over their value chains to identify and mitigate human rights, and in most cases, environmental issues.

• A ‘value chain’ is a broad concept. While the definition varies between legislation, it can encompass the company itself, its subsidiaries and direct and indirect suppliers, and the actions and processes used by these entities to bring a product to the end consumer and dispose of it.

• Most existing and proposed due diligence laws do not explicitly refer to climate change impacts, but relate to climate-adjacent issues such as deforestation, environmental damage and human rights, which may bring climate change impacts into scope.

• The proposed EU Corporate Sustainability Due Diligence Directive goes further, requiring in-scope companies to ensure that their business model and strategy are compatible with the transition to a sustainable economy and the limiting of global warming to 1.5°C in line with the Paris Agreement, and requiring board members to take climate change into account when acting in the best interests of the company.

• UK courts have signaled that they may take a broad approach to parent company liability, which may be persuasive in other common law jurisdictions and have implications for multinationals with UK-incorporated parents.

• Companies disclosing scope 3 emissions targets should consider what measures they can take to ensure these may be encouraged or enforced throughout their value chains.