| The Commonwealth Climate and Law Initiative has partnered with the Climate Governance Initiative to prepare this Briefing Note for Boards on climate change-related litigation. This briefing note expands on the legal risk trends identified and discussed in the Quarterly Update for the CGI network, available here. |

Climate change litigation is increasing, both in terms of the number of cases being brought and the routes which claimants are taking. Claims against governments can affect the policy and operating environment for companies or result in delays or rejection of environmental approvals for projects. Litigation is increasing against companies and now the first claims are being brought against directors and officers for their actions or perceived inaction on climate issues in their governance, disclosure and oversight of risk management and strategy.

| Key trends in climate litigation · Advancements in climate change attribution science are being tested in a new generation of climate damages claims, with claimants presenting to the court scientific evidence on the causal chain between the defendant’s emissions and climate impacts. · Claims cover the whole range of laws and forums, from corporate to contract law, human rights to tort law, in domestic and international courts to investment arbitration tribunals, seeking remedies from damages to declarations on breaches of rights, duties of care, misleading disclosures, or refusal of project approvals. · Physical and transition risks catalyse legal risk, and the litigation that arises does not respect geographic boundaries. One physical or transition risk, or set of impacts after the materialisation of that risk, can give rise to multiple legal actions within and across different jurisdictions. · Claims that have been successful against governments are being tried against corporations, with a duty of care claim against the Dutch government replicated against Shell in the Milieudefensie case. Directors and officers are in the sights of strategic claimants. Legal actions and arguments against governments today foreshadow potential claims against corporations in the near future, while claims against corporations could be stepping stones to or inspiration for claims against individuals in the near future. · Litigation alleging “greenwashing” is on the rise. To date these cases are mainly being brought by NGOs against high-emitting companies, and they are based on statements in public filings and/or advertising. · Disruption to business operations and supply chains caused by the impacts of climate change increase the likelihood of traditional compensatory litigation for contractual default or damage to third parties. · Not all climate litigation is ‘pro’ climate action. There is a growing countertrend of companies and other entities seeking to challenge climate change policies and regulations, or seeking compensation for the impacts of that regulation on their operations or assets. |

What is climate change litigation?

While climate litigation cases have so far found most success against national governments or government bodies, climate-related claims are increasingly being brought against private entities.

‘Climate litigation’ describes a rapidly developing body of cases that go beyond environmental law. It includes cases brought under corporate and securities laws, human rights and tort, domestic and international law, investment and trade law. Some cases involve novel questions of science or human rights, while others involve standard application of contract or administrative law, as applied to a climate-related issue or damage.

The Grantham Research Institute at the London School of Economics, which monitors and reports on climate litigation, publishes an annual snapshot of global climate litigation. The 2022 report notes that cases against private sector entities, including not only fossil fuel and cement companies, but also banks, pension funds, asset managers, insurers and major retailers, are likely to increase.

This update reviews significant developments in climate change litigation which are most likely to impact private companies and their boards, including:

- Fiduciary duty claims, for which shareholders may have a renewed appetite following recent cases.

- Greenwashing and misleading disclosure claims, which are likely to increase in the near future as companies’ net-zero commitments come under scrutiny, and which may lead to direct liability for directors.

- Climate damages claims, with sub-national governments and citizens using developments in climate change attribution science.

- Human rights-related claims, which potentially offer a new risk in relation to climate change for private companies.

- Compensatory claims, arising as the impacts of climate change cause damage to assets and third parties, and breaches of contract.

- Anti-climate litigation, as entities bring claims against governments challenging climate policies and their effects.

Climate litigation – a global flood

Over 2,000 climate litigation cases have been brought to date, predominantly in the US, with a significant number in the UK, the EU and Australia. The Global South is seeing an upswing in cases, from cases about government inaction on adaptation, Leghari v Pakistan, through to deforestation and human rights cases in Colombia and Brazil: Future Generations v Ministry for the Environment Colombia and PSB et al v Brazil.

The number of cases is increasing, as are the sophistication of arguments and expansion into new jurisdictions, as strategic litigants seek to replicate successes in new jurisdictions or against additional government or corporate defendants.

As many of these cases may take novel legal arguments, or consider new scientific developments, courts in many jurisdictions may be facing them for the first time. Judges considering novel climate change-related questions in their home jurisdictions look to international norms and standards.

Climate change and climate change litigation do not respect geographic or jurisdictional boundaries. The physical and transition risks of climate change materialising in one jurisdiction can have impacts on companies headquartered in another, due to multijurisdictional corporate structures, supply chains and financial arrangements (as discussed in a UNEP FI report in 2021).

Likewise, companies headquartered in one jurisdiction may face claims relating to their own actions – or even their subsidiaries or financed entities – in another jurisdiction. For example, in Envol Vert v Casino a French NGO brought a claim against the supermarket chain Casino alleging that Casino’s Brazilian subsidiary receives meat products from illegally deforested areas, and that Casino had failed to identify this risk in accordance with the ‘duty of vigilance’ under French law. A similar claim has been brought by another group of French NGOs against BNP Paribas for failing in its duty to take action on climate change, with the aim of preventing BNP Paribas from financing the development of fossil fuels. Following the launch of the claim, BNP Paribas has announced that it will no longer provides any financing dedicated to the development of new oil and gas fields.

Litigation as a policy driver

There have been several high-profile cases brought against national governments which seek to influence national policy and legislation on climate change (examples include Urgenda v Netherlands, Neubauer v Germany (in both of which the claimants were successful) and Kim v South Korea (ongoing)).

While these cases do not directly impact companies, they can significantly influence the business environment in which companies operate. For example, governments could introduce more stringent emissions standards, accelerate adaptation measures, adopt more stringent permitting requirements, and introduce climate-related reporting and disclosure obligations (as discussed in a 2021 paper by the Geneva Association).

1 FIDUCIARY DUTY CLAIMS

Analysis by the CCLI and Climate Governance Initiative has highlighted that boards in many jurisdictions around the world may face a claim from their shareholders for alleged breaches of their fiduciary duties.

Claims alleging that a board has failed in its fiduciary duties by allowing their company to make allegedly misleading disclosures, or failing to disclose climate risks, have been brought against ExxonMobil’s board (Von Colditz v ExxonMobil).

New claim may act as a ‘test case’ for climate fiduciary claims

The viability of a climate-related fiduciary duty claim is being tested in ClientEarth v Shell, a new claim brought by environmental NGO ClientEarth as a shareholder of Shell against its board. ClientEarth allege that Shell’s directors have breached their duty to act in the best interests of the company by failing to develop and implement a climate strategy that aligns with the Paris Agreement goals, increasing its risk of stranded assets and having to make write-downs (due to both physical and transition risks).

An initial judgment on this claim was given in May 2023, refusing ClientEarth permission to continue the claim. At the time of writing, ClientEarth may opt to apply to the court for an oral hearing on permission.

While the judgment notes that Shell does not deny that it faces climate risks, the judgment finds that ClientEarth has failed to establish that Shell’s board have breached their duties in how it has managed these risks, noting that the existence of Shell’s transition plan demonstrated that the board must have considered such risks. Boards should ensure that they have robust plans to identify and manage climate risks to ensure that they are similarly protecting themselves.

Additionally, the judgment notes that the court will generally be unwilling to interfere in commercial decisions, in particular where the business is large and complex. It may follow from this that, conversely, boards may take comfort that taking ‘pro-climate’ action is unlikely to lead to claims against them, as no such claims are noted in the main climate litigation databases.

Greenwashing risks may increase the risk of a fiduciary claim

Boards could face direct liability for breaches of their duties in relation if their company sets misleading net-zero targets or sustainability commitments (in addition to misleading disclosure claims, on which see the section on Greenwashing below). For example, in McGaughey v USS, beneficiaries of a UK pension fund brought a claim against the directors of the fund management company alleging that its continued investments in fossil fuels, despite statements by the company that climate change is a material financial risk to the returns of its assets, constituting a breach of directors’ duties (as the claimants are not shareholders of the company, this claim was brought as a common law derivative action, and the court found that the company had not suffered a financial loss which would allow the claimants to bring a common law claim – the position is different for shareholders, who are allowed to bring statutory claims for actual or proposed breaches of duty).

‘Books and records’ requests to seek information on directors’ knowledge and oversight of climate-related issues

In a recent case, Abrahams v Commonwealth Bank of Australia, shareholders in the Commonwealth Bank of Australia successfully obtained a court order obliging the bank to disclose internal documents on seven oil and gas projects funded by the bank, which the shareholders allege potentially infring![]() e the bank’s environmental and social policies. In the US, requests like these often precede fiduciary duty claims against directors.

e the bank’s environmental and social policies. In the US, requests like these often precede fiduciary duty claims against directors.

| Box 1 – Stakeholder governance as good governance There is an increasing focus on stakeholder-focused, long-term value creation as the purpose of a company. When considering how to act in the best interests of their company, boards may wish to consider their company’s social licence to operate, which is essential to a corporation’s business. As discussed in the World Economic Forum report on The Future of the Corporation, a company’s social licence depends upon its purpose, strategy, culture, values and governance. Each of these requires identifying the company’s material stakeholders, and bringing their voice into decision-making. Generally, boards have a wide discretion to set their company’s purpose, and so should consider whether their company’s purpose should simply include compliance with relevant laws and regulations in pursuance of increased profits, or whether it should seek to avoid negative impacts on wider stakeholders such as society and the environment, or additionally commit to creating a public benefit. In the climate context, boards should consider how their company’s material stakeholders have been identified (including the environment and communities likely to be disproportionately affected by the impacts of climate change, such as indigenous communities and younger generations), and assess its stakeholder engagement mechanisms to bring these voices into the boardroom. Boards should also ensure that their performance metrics and compensation are aligned with the company’s wider purpose and sustainability goals. |

Greenwashing risks may increase the risk of a fiduciary claim

Boards could face direct liability for breaches of their duties in relation if their company sets misleading net-zero targets or sustainability commitments (in addition to misleading disclosure claims, on which see the section on Greenwashing below).

For example, in McGaughey v USS, beneficiaries of a UK pension fund brought a claim against the directors of the fund management company alleging that its continued investments in fossil fuels, despite statements by the company that climate change is a material financial risk to the returns of its assets, constituting a breach of directors’ duties (as the claimants are not shareholders of the company, this claim was brought as a common law derivative action, and the court found that the company had not suffered a financial loss which would allow the claimants to bring a common law claim – the position is different for shareholders, who are allowed to bring statutory claims for actual or proposed breaches of duty).

Similarly, ExxonMobil’s board is the subject of an ongoing shareholder claim regarding allegedly misleading disclosures about stranded assets, which includes a claim that its directors breached their fiduciary duties by allowing the company to make these disclosures (Von Colditz v Exxon Mobil).

2 GREENWASHING AND MISLEADING DISCLOSURE CLAIMS

One type of claim which has increased recently is so-called ‘greenwashing’ claims. This term is used to cover a number of causes of action in company and consumer law, essentially for misleading claims made by companies to investors or consumers about the climate impacts or sustainability of their activities or products.

| Box 2 – Key trends in greenwashing Claims regarding misleading statements on climate and sustainability have been brought in domestic courts under company or consumer law, as well as the non-judicial bodies that administer international ‘soft law’, such as the OECD Guidelines. Greenwashing claims are likely to increase with the proliferation of net-zero and other sustainability commitments by companies and as strategic litigants demand ‘action not words’. Directors could face personal liability for misleading disclosures or for failing to fulfil their duties in respect of climate change – and disconnects between actions and words could make such claims more likely. |

Sustainability and net-zero claims are subject to increased scrutiny and greenwashing claims are likely to increase against both corporates and directors and officers

Companies’ sustainability claims[1] are being made in a context of increased scrutiny from NGOs[2] and regulators, as well as moves to mandate climate and sustainability disclosures. An actual or perceived disconnect between what companies say and do may lead to greenwashing claims. A report by the LSE Grantham Institute provides examples of how greenwashing claims can affect companies in multiple industries (in particular, oil and gas, energy, transportation and agriculture) and take effect through multiple legal routes, and suggests that these claims are likely to increase.

Many jurisdictions, including Australia, Canada, the US and the UK, have laws under which directors, and in some cases officers, may be held personally liable for losses suffered by investors relying on misleading disclosures in certain corporate filings. Net-zero commitments are generally forward-looking statements, which are often subject to a ‘safe harbour’ which protects the board and company from litigation; however, this protection is generally subject to the disclosures being reasonable, and/or accompanied by relevant explanations or assumptions. This ‘safe harbour’ is being tested in an Australian case against oil and gas company Santos in relation to its 2040 net-zero target and statements on gas as a ‘clean fuel’: ACCR v Santos.

More general sustainability statements may also be subject to securities litigation; a recent class action by Oatly’s shareholders against the company and its board (Bentley v Oatly Group) alleges that the company made materially false and misleading statements, and also failed to disclose, material adverse facts about Oatly in its filings, including the company’s financial metrics, sustainability, and growth in China.

A court in Australia has allowed a claim, O’Donnell v Commonwealth of Australia, to proceed against the Australian government that alleges a lack of climate change disclosures in relation to sovereign bonds misled investors. The claim for breach of duties against the public officers who signed off on these disclosures (who owe duties of care and diligence akin to directors) was dismissed as the bond investor was not the proper person to bring that claim. While this claim is against the government, similar claims could be brought against private issuers.

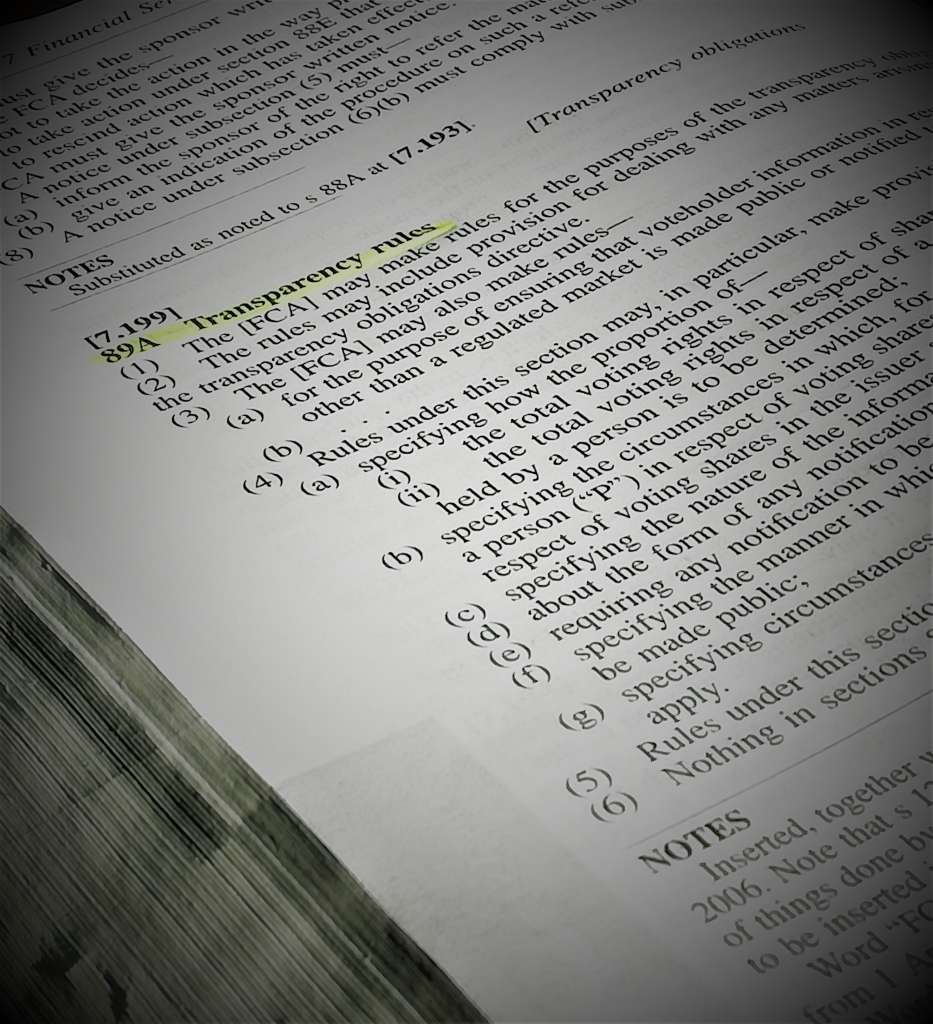

Securities regulators are also increasingly paying attention to greenwashing: the Australian Securities and Information Commission (ASIC) is conducting a review into the issue, and has intervened regarding a mining company’s disclosures on its net-zero targets; the UK Financial Conduct Authority (FCA)’s 2021 letter to the chairs of authorised fund managers set out its views on greenwashing; and the US Securities and Exchange Commission (SEC) has announced a Climate and ESG Task Force which will examine misstatements in disclosures, and has proposed changes to its rules to require climate-related disclosures. Regulators are taking steps to enforce existing laws on sustainability issues: in May 2021, the SEC charged BNY Mellon Investment Adviser for misstatements and omissions about ESG considerations for which the company paid $1.5 million, has announced an investigation into Deutsche Bank’s asset management arm DWS regarding its use of sustainable investment criteria (the German Federal Financial Supervisory Authority has raided DWS’ offices in a related investigation), and is also undertaking a similar investigation into Goldman Sachs. ASIC has launched its first court action against alleged greenwashing conduct, commencing civil penalty proceedings in the Federal Court against Mercer Superannuation (Australia) Limited for allegedly making misleading statements about the sustainable nature and characteristics of some of its superannuation investment options.

NGO’s have also made complaint to regulators regarding alleged greenwashing. In the UK, the NGO ClientEarth has brought a claim against the FCA alleging that it has failed in its role as regulator by allowing an oil and gas company to issue a prospectus which, ClientEarth argues, does not adequately describe the climate risks facing the company. While this claim has been brought against a regulator, rather than a private entity, its outcome could affect the regulator’s attitude towards climate risk. In the US, NGO Global Witness has lodged a complaint with the SEC regarding Shell’s investment in renewable energy, which it alleges mostly comprises investment in gas, which it is alleged is misleading.

Advertising standards and consumer law: statements outside of regulatory filings are also subject to increasing scrutiny and challenge

Greenwashing claims can be made through a variety of different channels, not all of which are as cost- and time-consuming for claimants as formal litigation. While these ‘complaints’ do not lead to court orders, corporate respondents may be subject to reputational issues on the bringing of a claim or adverse findings, as well as complying with any orders the regulatory or body is entitled to make.

One way in which civil society organisations are challenging companies’ claims is through complaints to advertising regulators and other non-judicial organisations. In December 2019, ClientEarth made a complaint to the UK National Contact Point (NCP) for the OECD Guidelines alleging that an advertising campaign run by BP plc breached the OECD Guidelines (non-binding, but government-supported, guidelines on responsible business conduct) by misleading consumers on matters such as the role of renewables in BP’s business and the carbon emissions caused by burning gas. BP subsequently withdrew the advertisements, so the complaint did not proceed, but the NCP acknowledged the issue was ‘material and substantiated’.

A similar complaint has also been made regarding Italian oil company ENI’s net-zero commitments. In February 2022, a group of Italian NGOs brought a complaint to the Italian NCP alleging that ENI has failed to identify and attempt to mitigate the negative impacts of its net-zero strategy, which include increased emissions in the short term, and utilises controversial techniques such as carbon capture and storage. The same NGOs have also brought a complaint in respect of multinational intensive farming companies headquartered in Italy.

BP’s 2019 advertising campaign and related public communications mislead the public and accordingly conflict with the OECD Guidelines. Its two themes […] contain messages that create false perceptions about BP’s business and strategy, energy and climate issues, and sustainable consumption choices.

ClientEarth, Complaint against bp in respect of violations of the oecd guidelines, 3 december 2019

Complaints have been made to national advertising regulators (and upheld) in respect of misleading climate-related claims by, for example, Oatly (a manufacturer of oat milk), Ryanair (a European airline), Good Energy Ltd (a renewables-focused energy company); Firstgas Group (a natural gas company); Royal Dutch Shell (an oil and gas company); and Petronas (an oil and gas company). There are signs that regulators expect such complaints to continue; in December 2021, the UK Committee of Advertising Practice produced guidance on misleading environmental claims.

Regulators themselves are demonstrating increasing interest in greenwashing; for example, the UK Competition and Markets Authority has released a consultation noting the existing laws which companies could breach with misleading environmental claims, and calling for views on whether new legislation is required to protect consumers.

Consumers and civil society entities may also bring litigation in respect of misleading practices under consumer protection laws. For example, claims are underway in Massachusetts and Columbia against ExxonMobil, alleging that ExxonMobil’s advertising practices deceived consumers by misrepresenting the environmental benefits of some of its products, the level of its investment in clean energy, and failing to disclose the risk of climate impacts caused by its fossil fuel products (Massachusetts v ExxonMobil; Beyond Pesticides v ExxonMobil).

In the EU, the pork producer Danish Crown has been sued in respect of allegedly misleading advertisements about the climate impact of its products (which the company has subsequently dropped) (Vegetarian Society of Denmark v Danish Crown), and a claim has been brought against TotalEnergies alleging that its net-zero advertising campaign breaches European consumer protection law by failing to acknowledge the company’s expanding fossil fuel activities (Greenpeace France v TotalEnergies). Litigation has also been brought against Dutch airline KLM, alleging that its advertising was misleading consumers regarding the sustainability of air travel, and against Delta Airlines in the US regarding its claim to be the “world’s first carbon-neutral airline” and the degree to which it relies on carbon offsets.

In Canada, the Competition Bureau has reportedly launched an investigation into Royal Bank of Canada (RBC) over allegations that the bank had misled customers on its commitments regarding climate action. This follows a complaint by NGO EcoJustice alleging that RBC’s marketing materials represented that it supports action to address climate change, and are misleading in light of RBC’s funding of fossil fuel development and expansion.

Finally, companies are now the subject of litigation regarding their published net-zero targets in their corporate disclosures. In Australia, the energy company Santos has been sued for misleading practices regarding its net-zero targets (ACCR v Santos), and in the US, Delta Airlines

3 CLIMATE DAMAGES LITIGATION

One of the longest-running trends in climate litigation is the series of cases seeking to hold companies liable for damages suffered as a result of the effects of climate change. Initial cases in this series were brought by US state attorneys against the major oil and gas companies in those states (the so-called‘Carbon Majors’ cases, including City of New York v Chevron Corporation and Ors.,; County of San Mateo and Ors. v Chevron Corp. and Ors.; B.P. Plc and Ors. v Mayor and City Council of Baltimore).

A similar case, City & County of Honolulu and BWS v. Sunoco, LP, et al, has been allowed to proceed to full trial – the first such case to do so. The plaintiffs allege that the defendants were under a duty to disclose the dangerous effects of greenhouse gas emissions, and that failing to do so exacerbated the plaintiffs costs in adapting to climate change.

These cases are not exclusive to the US. In Lliuya v RWE, a Peruvian farmer, who lives in a town below an expanding glacial lake, has brought a claim against German utility company RWE for the cost of measures to protect the town from the risk of flooding. The claimant is claiming 0.47% of the costs, reflecting RWE’s historical contribution to climate change.

These cases face significant procedural hurdles, including determining which courts are the correct venue to hear the claims, and demonstrating that the claimants’ losses were caused by the defendant’s actions (although a recent paper has found that attribution science may assist claimants in this latter respect). However, a successful claim in this area would be likely to lead to multiple group claims against companies with high greenhouse gas emissions, and so boards should remain alert to developments in this area.

Here, the causes of action may seem new, but in fact are common. They just seem new – due to the unprecedented allegations involving causes and effects of fossil fuels and climate change. Common law historically tries to adapt to such new circumstances.

Ruling 22 February 2022 RE: City & County of Honolulu and BWS v. Sunoco, LP, et al; Civ. No. 1CCV-20-0000380 (First Circuit Court, State of Hawai‘i)

4 HUMAN RIGHTS

A further trend which may increase the risk of climate litigation impacting private companies is the integration of human rights-based arguments into these lawsuits (both under the European Convention of Human Rights (ECHR) and more broadly, including constitutional rights). Generally, ECHR-related claims may only be brought against public bodies (such as governments and government departments), and climate litigants are well-versed in such claims. For example, humans rights elements were part of successful claims regarding the adequacy of climate change laws, policies and/or actions against the governments of France (Notre Affairs a Tous v France), Germany (Neubauer v Germany), Brazil (PSB et al. v. Brazil), and Colombia (Future Generations v Ministry for the Environment Colombia), among others. This trend may be increasing due to recognition of companies’ human rights responsibilities by international, national and regional bodies (as discussed in a recent study). Claims seeking further rulings on the impacts of climate change on human rights continue; for example, a ruling is being sought from the European Court of Human Rights against the governments of the signatories to the ECHR (Duarte Agostinho and Others v. Portugal and 32 Other States), and the Commission on Human Rights of the Philippines has published its findings that the world’s biggest carbon polluters could be held liable for their role in contributing to climate change.

| Box 3 – Summary of human rights litigation elements Human rights claims directly against private companies are difficult to bring, or even not possible, under the laws of many jurisdictions. However, human rights arguments may be increasingly likely to feature in claims brought against companies for harms caused by their emissions – particularly in jurisdictions where governments have been found liable for breaching human rights by failing to act on climate change. Companies may face penalties or liability where their existing legal obligations include human rights elements (such as risk reports, compliance statements and supply chain due diligence). Certain companies and boards in the EU may face increased liability under a new proposed supply chain due diligence Directive. |

The UN Human Rights Council has recently passed a number of resolutions recognising the right to a healthy environment and acknowledging the risks posed by climate change to human rights. While these are not legally binding on governments or private companies, resolutions and Human Rights Council reports have been used by claimants in successful cases to demonstrate that they have suffered loss.

In a notable development, the UN has adopted a resolution to seek the opinion of the International Court of Justice (ICJ) on the legal consequences of nation states damaging the climate in such a way that it causes harm to other states – again, while the opinion of the ICJ will not be binding on corporations, it may increase the pressure on states to increase the ambition of their climate policy.

Human rights claims against governments may leverage claims against companies

The extent to which ECHR or constitutional rights issues can be incorporated into claims against private entities will depend on the laws of the jurisdiction in which the claim is brought and the facts of the dispute. However, in some jurisdictions, cases against governments which have proven a link between a failure to mitigate climate change and a potential breach of such rights may pave the way for similar claims against private bodies.

In May 2021, a Dutch court ordered Royal Dutch Shell to reduce the CO2 emissions of its corporate group by 45% by 2030, relative to 2019 levels, in Milieudefensie v Royal Dutch Shell. The court found that as a result of the CO2 emissions of the Shell group, certain Dutch citizens would suffer harm, meaning that Shell would fail to meet the standard of care required of Dutch persons. In coming to this decision, the court considered the impacts of Shell’s actions on the ECHR rights of the claimants, based on a successful claim against the Dutch government in 2020 (Urgenda v Netherlands). The claimant, Milieudefensie, has now informed 30 other multinational companies that it is willing to take them to court, using the same type of claim as used against Shell, if they do not produce transition plans.

| Box 4 – Milieudefensie v. Royal Dutch Shell: raising the bar on compliance? As well as considering the impacts of Shell’s actions on the ECHR rights of the claimants, the court considered how onerous it would be for RDS to meet the standard. Interestingly, the court recognised the far-reaching consequences of its findings on the standard for Shell, but stated that the interests of the claimants outweighed the Shell group’s commercial interests. This finding obliges Shell to update its business model and strategy and take actions to meet the emissions reduction obligation in a way which may not be profitable, at least in the short term. This appears to oblige Shell’s directors to take actions which, on one view, may not be in the best (financial) interests of the company, narrowly interpreted through a short-term shareholder wealth maximization lens. However, this does not override the company’s obligation to comply with the law, and so Shell is obliged to comply with the ruling (Shell has announced that it will appeal the ruling, but until and unless it is overturned, Shell will still need to comply). |

Likewise, a German NGO has brought a claim against BMW based on a prior successful constitutional rights-based claim against the German government. In the claim against the government, Neubauer v Germany, the court held that the German government’s statutory targets for greenhouse gas reductions by 2030 were insufficient to avoid it having to take significant actions after 2030 in order to meet its reduction targets; such actions were likely to disproportionately affect the young claimants’ constitutional right to freedom. Following this, and the judgment against Royal Dutch Shell, the German NGO claimed that BMW, Mercedes-Benz, is violating citizens’ fundamental right to climate protection and impinging on the rights and freedoms of future generations by not adhering to a ‘fair’ carbon budget (Deutsche Umwelthilfe (DUH) v BMW, DUH v Mercedes-Benz).

These claims do not seek a ruling that the company has already breached the claimants’ legal rights, but rather argue that a company is likely to cause harm (including by breaching ECHR rights) in the future. If a company has a Paris Agreement-aligned transition plan, or other appropriate strategies to limit its impact on climate change, this may help it to demonstrate that its impacts on the claimant are likely to be limited.

Human rights issues for companies may arise under existing legislation

Human rights-related claims against private entities do not necessarily require a finding on human rights against a national government, and boards should be alert to existing laws which require them to consider human rights issues which could give rise to climate-related claims.

Rulings which draw on human rights may have significant impacts on a company’s business model. The Dutch case against Royal Dutch Shell provides one example of this (see Box 4). In another case, Sustaining the Wild Coast v Minister of Mineral Resources and Energy, a South African court granted an order prohibiting Shell from carrying out exploratory drilling, finding that Shell had failed to properly consult the claimants, and the proposed exploration was likely to infringe their constitutional rights to a healthy environment and to the enjoyment of their cultural community. In a similar case, an indigenous community in Colombia has brought a claim challenging mining permits issued to a local mining company owned by Glencore on the basis that the permits were issued contrary to proper process, and infringe the rights of the community (Indigenous Communities v Minister of the Environment). In EarthLife Africa Johannesburg v Minister of Environmental Affairs, a South African court held that environmental impact assessments required for a coal mine must take into account climate change considerations, or risk breaching citizens constitutional rights. In Australia, a court has ruled that a coal plant permit was granted unlawfully due to its impacts on the human rights of the local Indigenous population (Waratah Coal Pty Ltd v Youth Verdict Ltd). In Australia, a court has ruled that a coal plant permit was granted unlawfully due to its impacts on the human rights of the local Indigenous population (Waratah Coal Pty Ltd v Youth Verdict Ltd).

While human rights elements of claims against private entities are still likely to be rare, directors should be aware that in jurisdictions where climate change has been established as potentially breaching human rights, their companies may face increased litigation risk, either by claimants adopting similar strategies to those used against governments, or by breaching legislation through inadequately considering human rights impacts.

Supply chain due diligence

In 2019 a French NGO brought a claim against the oil and gas company Total (as it was then called) alleging that its mandatory report on risks (including human rights risks) failed to comply with France’s ‘duty of vigilance’ legislative requirements since it did not consider climate change-related impacts on human rights. A claim under this law has also been brought against supermarket chain Casino regarding their alleged failure to report on human rights and environmental risks failed to comply with the duty of vigilance (Envol Vert v Casino).

This litigation could be expanded to further jurisdictions if EU jurisdictions adopt proposed legislation to make large companies responsible for adverse human rights and environmental impacts in their supply chains, which may include additional responsibilities and liabilities for directors.[3]

5 COMPENSATORY CLAIMS

Not all climate litigation is activist-led or strategic. As the impacts of climate change begin to impact business models, assets and increase risk for companies, companies should expect to face increased litigation risk through more ‘everyday’ channels.

For example, climate change increases the likelihood of extreme weather events, which can cause losses to individuals who may seek to recover these through litigation. In 2017 and 2018 alleged failures of the Pacific Gas and Electric Company (PG&E)’s power transmission equipment caused devastating wildfires in drought-affected California, causing extensive property damage and loss of life. Following this, PG&E faced a huge number of civil lawsuits, regulatory investigations, and criminal charges, which led to PG&E facing liabilities of up to USD 30 billion. Bond owners and shareholders in PG&E have since brought multiple claims against the board members alleging that the company failed to manage the risk of wildfires, and made misleading disclosures about the company’s climate change and wildfire resilience prior to the Californian 2017 and 2018 wildfires.

Likewise, both one-off weather events and gradual onset changes can create operational risk for companies, increasing the risk of that company being unable to fulfil its contractual obligations. These operating risks can become bet-the-company litigation for a wind farm operator, as was seen with case of Stephens Ranch v Citi Energy. During the ‘once in a generation’ Texas winter storms in February 2020, wind farm operator Stephens Ranch was knocked offline and unable to generate power, leading to it breaching a power supply agreement with Citigroup Energy. Citigroup was then forced to purchase electricity from other sources at a vastly inflated price of $9,000/MWh (a price set by the regulator to incentivise increased supply and reduce the risk of blackouts). Stephens Ranch sought a declaration from the court that it was not liable to Citigroup, since the winter storm was a force majeure event. The judge disagreed (acknowledging Citigroup’s arguments that a decade earlier the regulator advised wind farms to ‘winterise’ their turbines for climate impacts but ultimately deciding on technical contractual interpretation grounds), and Stephens Ranch went on to settle the claim.

| Box 5 – Beyond activism: where operating risks become litigation risks Companies may find themselves facing claims for compensation from contractual counterparties over supply chain disruption, or from injured parties through extreme environmental events for which they may be liable. This litigation may not even mention climate change, but arises through the kind of extreme weather events made more intense and frequent in a warming climate. ‘Green’ companies are not protected from this litigation, just as much as they are not protected from the physical risks which catalyse it. |

Companies operating in sectors which are particularly likely to be exposed to climate change impacts (such as energy, agriculture and industries with significant infrastructure) should be aware that their business models may face increasing disruption, and should consider how they could structure their contractual relationships and ensure compliance with safety regulations in order to minimise the risk of litigation.

6 ANTI-CLIMATE LITIGATION

As well as activists seeking to encourage companies to take steps to mitigate their climate change impacts, and the impacts of climate on the company, there is a growing counter-trend of companies and other entities seeking to challenge climate change policies and regulations. As more regulations requiring specific actions from companies on climate change enter into force, for example governance and disclosure of climate change risks, there may be an increase in cases seeking to challenge the validity of these regulations.

Generally, these claims are brought under arbitration rules, potentially in order to enjoy the confidentiality of such proceedings. This may indicate that companies are concerned about the reputational impacts of litigating against climate policy, in particular where such policy may be viewed favourably by its shareholders and customers.

In the EU, claims have been brought by coal power companies against the Dutch and German governments under the Energy Charter Treaty, which aims to protect foreign investors in energy (RWE v Netherlands; Vattenfall v Germany). The companies allege that the governments have failed to allow adequate time and resources to transition away from coal. The Energy Charter Treaty aims to protect foreign investments in energy and allows foreign investors to claim compensation through arbitration for losses due to government regulation. However, these cases may have been impacted by a ruling (in a different case, Republic of Moldova v Komstroy LLC) by the Court of Justice of the European Union in 2021 which found that the arbitration process under the Energy Charter Treaty does not apply within the EU.

In the US, an NGO and a number of individual members have brought a claim against the New York City Employees’ Retirement System and two other pension funds, alleging that the funds have breached their fiduciary duties by divesting from fossil fuel assets allegedly for political motivations (Wong & Ors. v New York City Employees’ Retirement System & Ors.).

Companies may also attempt to influence climate policy through political lobbying. However, activist shareholders are increasingly attempting to increase transparency on this. From 2020, shareholders, including institutional investors, have brought resolutions requesting that companies assess their climate related lobbying and report to shareholders. The number of such resolutions increased in 2021, and already a significant number of resolutions have been brought in 2022. In at least one case, this has progressed to litigation: in October 2022, a number of institutional pension funds brought a claim against Volkswagen to force the company to table a resolution requiring it to disclose its lobbying activities – following this, Volkswagen published a report on its climate lobbying positions in May 2023.

In cases where companies have made climate commitments, actions challenging climate policy may increase the likelihood of activists bringing greenwashing claims (see above). Boards should consider whether, given the potential reputational risks and the rapidly shifting regulatory and policy environment, challenging policy or regulation in this way could be considered to be in the best interests of the company, taking a long-term view.

Further reading

- A non-exhaustive selection of useful resources on climate litigation are listed below:

- The Grantham Research Institute at the London School of Economics and Political Science (see website here) publishes annual ‘snapshots’ of climate litigation, as well as papers on specific climate litigation risk. The July 2021 snapshot can be read here, and a January 2022 paper on potential liability for greenwashing can be found here.

- The forthcoming snapshot for 2022 will provide further updates on climate litigation trends.

- Grantham Research Institute researchers published a paper analysing human rights trends in climate litigation in March 2022, which can be found here.

- The Geneva Association’s April 2021 insights into the evolving global landscape of climate litigation is available here.

- The United Nations Environment Programme Finance Initiative (UNEP FI) publishes materials to assist financial institutions in adapting to climate risks. UNEP FI and Australian law firm MinterEllison have published a paper on litigation risk as a driver of adaptation to physical climate-related risks, and as a consequence of a failure to adapt: see here.

- Databases of climate change litigation cases, including documents and information are maintained by the following organisations:

- The Columbia Law School Sabin Centre for Climate Change Law maintains an online database of information and publicly available documents relating to climate change litigation: see here.

- The Grantham Research Institute maintains Climate Change Laws of the World, a database which contains information on legislation, policy and litigation related to climate change: see here.

- The Climate Rights and Remedies Project at the University of Zurich maintains a database on human rights-related climate cases: see here.

- The Platform of Climate Litigation for Latin America and the Caribbean (Plataforma de Litigio Climático para América Latina y el Caribe) is a database of climate litigation in Latin America and the Caribbean: see here.

[1] Analysis by the Energy & Climate Intelligence Unit of 2,000 publicly-listed companies around the world found that as of March 2022, over 600 had published commitments or policies relating to reducing the company’s impact on climate change. The global Race to Zero campaign, through which real economy actors pledge to achieve net-zero emissions by 2050 at the latest, now has over 3,000 company signatories (over double the number of companies setting net-zero emissions pledges as of January 2021), and now covers nearly 25% of global emissions and over 50% of global GDP. This trend is also being driven by investors, as shareholder resolutions requesting that companies disclose climate change-related information and management plans have increased significantly over the last few years. Finally, climate change-related disclosures are becoming mandatory in some jurisdictions. Some first-mover jurisdictions, such as the UK, are legislating to require certain companies to disclose climate change-related information and transition plans.

[2] For example, in January 2022, a report by the New Climate Institute analysed the net-zero targets of 25 major global companies, and found that the companies’ emissions reduction commitments totalled less than 20% of their emission footprint. Similar research by voluntary disclosure organisation Climate Disclosure Project found that despite considerable discussion in disclosures around net-zero transition plans, only 6% of organisations analysed fully disclosed details of their net-zero targets. The UK NGO ClientEarth maintains the ‘Greenwashing Files’, an online database in which it identifies and analyses climate and sustainability claims made by large companies in the energy and petrochemical industries.

[3] In February 2022, the European Commission adopted a proposal for corporate sustainability due diligence, which introduces a duty for certain companies to conduct supply chain due diligence on human rights and environmental issues. These companies are required to integrate due diligence into their policies, identify actual or potential adverse environmental and human rights impacts, and prevent, mitigate or minimise these, as well as publicly communicate how they are fulfilling these obligations. Where companies fail to prevent potential adverse impacts, or fail to bring actual adverse impacts to an end, they may face civil liability under the proposed Directive.

Under the proposed Directive, directors of these companies are to be responsible for putting in place and overseeing their companies’ due diligence policies, and should take steps to adapt their companies’ strategies to align with the requirement to prevent and end adverse environmental and human rights impacts. The proposed Directive also clarifies the scope of directors’ duty to act in the best interest of their companies, stating that for the companies covered by the proposed Directive, directors must take into account the consequences of their decisions for sustainability matters, including climate change and human rights, in the short, medium and long term.